Introduction:

In today’s interconnected world, the flow of goods between nations tells a story far bigger than numbers on a trade balance sheet. For the United States, trade with Russia has always been a mix of economics, politics, and energy strategy. But in the past few years, things have changed dramatically.

Once a steady trading partner for certain key commodities, Russia’s role in U.S. imports has diminished dramatically—shaped by sanctions, shifting energy policies, and the pursuit of supply chain security.

In 2024, the U.S. It brought in goods from Russia worth only around $3.27 billion. That’s a steep drop compared to the tens of billions traded annually just a few years earlier. And in 2025, the trends point even further toward a reduced dependency—especially in areas like crude oil, where the U.S. has turned to other partners.

Understanding In reality, U.S. imports from Russia—especially oil—play a role in shaping the global balance. But what share does it actually make up in America’s total imports?. It’s about recognizing which sectors remain tied to Russian supply chains, which industries have pivoted away, and how these changes impact everything from fuel prices to food production.

Table of Contents

What Does the US Import from Russia in 2025?

When people think of U.S.–Russia trade, oil is usually the first thing that comes to mind. But the reality in 2025 is far more diverse—and in some ways, surprising. While energy-related products were once a big part of imports, current trade flows show a very different picture.

- Fertilizers—Russia remains one of the world’s leading suppliers of fertilizers, and even in 2025, certain U.S. agricultural sectors rely on these imports for crop yields.

- Non-ferrous metals—items like palladium, aluminum, and nickel—remain crucial for U.S. manufacturing, especially in the automotive and tech industries.

- Inorganic chemicals—essential for industries ranging from pharmaceuticals to manufacturing.

- Uranium—Before the recent ban, Russia supplied a significant share of enriched uranium for U.S. nuclear reactors.

The shift away from Russian energy imports hasn’t erased these other categories—and in some cases, reliance remains significant.

A Drastic Shift: U.S.–Russia Trade in 2025

Trade Volume: A Sharp Decline

In 2024, the U.S. brought in only about $3.27 billion worth of goods from Russia—a huge drop compared to previous years.

As of mid-2025, total imports have remained subdued—just $2.1 billion through the first five months.

By comparison, bilateral trade in 2021 stood at a staggering $14 billion. Today, it’s a mere fraction of that figure

Why the Plunge?

Sanctions and political sanctions in response to Russia’s invasion of Ukraine drastically tightened trade. Despite these restrictions, the U.S. still imports essential items that it struggles to source elsewhere—or has strategic reasons to keep flowing.

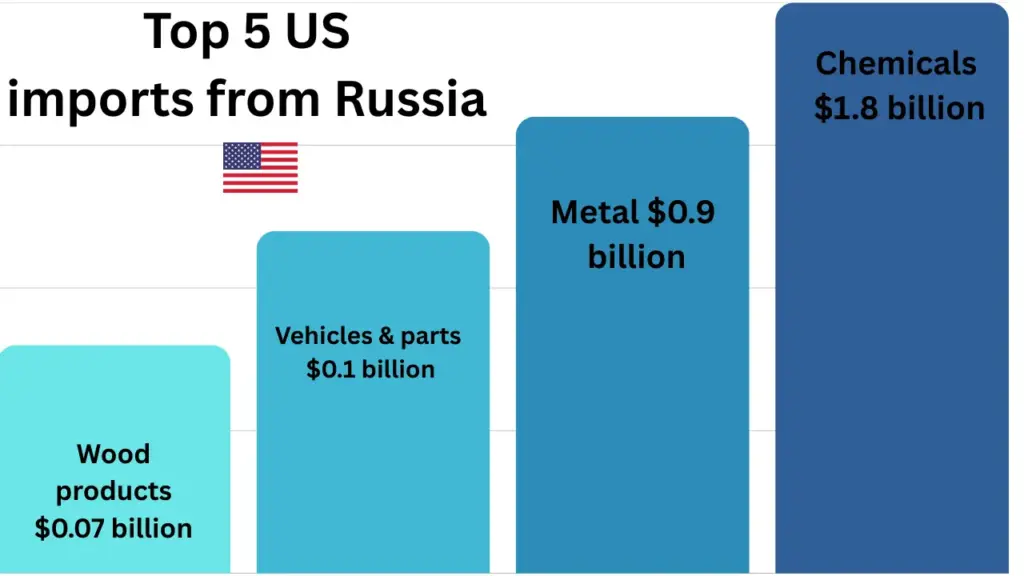

What the U.S. Actually Imports from Russia

Here’s where things get interesting—and surprising.

Fertilizers: Nourishing American Fields

Fertilizers like nitrogen-based, potash, and phosphate ones are still major imports. In aggregate, fertilizer imports from Russia exceed $1 billion annually—a critical asset for U.S. agriculture.

Uranium: Fuel for Nuclear Reactors

This one’s critical—and dramatic. Through May 2025, the U.S. had already imported over $596 million of enriched uranium from Russia—fuel for the nuclear reactors powering parts of our clean energy grid.

That said, a legislative act took effect in mid-2024 aimed specifically at cutting off U.S. uranium imports from Russia. It became law on May 13, 2024, limiting low-enriched uranium imports to bolster domestic supply chains.

Other Imports

The U.S. also brings in modest quantities of machinery, wood products, and chemicals, but these pale beside fertilizers, metal, and uranium in both volume and economic importance.

The US Oil imports and the Global Balance

Now, let’s pivot to a broader context: US oil imports and energy independence.

What Percentage of U.S. Oil Is Imported?

As of 2025, only 30–35% of U.S. Today, a smaller share of oil use comes from imports—a big drop compared to the mid-2000s, when over 60% was imported.

Domestic production—especially shale oil—now supplies about 65–70% of consumption needs.

Net Import Figures

The Energy Information Administration predicts net U.S. By 2025, crude oil imports are expected to fall to only 1.9 million barrels a day—down 20% from recent levels and the lowest since 1971

The Oil Import Puzzle Solved

The U.S. imports oil not out of necessity, but because of how oil infrastructure is designed. Refineries are optimized for heavy crude from countries like Canada, which carries geologic and logistical advantages.

U.S. Trading with Russia: Political and Strategic Ramifications

Sanctions vs. Reality

Even while Washington ramps up pressure, the U.S. continues to buy strategic imports—highlighting the tricky balance between values and necessities

Legislation like the Sanctioning Russia Act of 2025 proposes tariffs up to 500% on Russian energy, and even nations trading in Russian energy—like India and China—would face penalties

While political, such moves might also escalate energy prices globally—ongoing concerns cited by experts

Dependence Meets Pragmatism

- Uranium still flows, despite attempts to block it.

- Agricultural inputs like fertilizers are hard to substitute.

- These realities force pragmatic policy responses—even as lawmakers seek cleaner, more self-reliant alternatives

Why This Matters: Economic, Security & Strategic Stakes

Economic Impact

- Fertilizer shortages could spike crop prices.

- Metal supply disruptions could hinder manufacturing and auto production.

- Uranium restrictions could strain nuclear power operations without effective alternatives.

Energy Security & Supply Resilience

- Shale oil gives the U.S. strategic leverage—but refineries still need imported crude types to operate efficiently.

- The uranium ban is spurring investments in domestic fuel processing, aiming to reduce reliance on geopolitically risky supply chains.

Geopolitical Positioning

As global tensions continue—especially around Ukraine—trade becomes a signal. Cutting off or retaining imports sends strong messages, whether intentional or part of broader industrial dependencies.

FAQs:

1. Is the US trading with Russia in 2025?

ANSWER: Yes, but with major restrictions. While some non-sanctioned goods may still be exchanged, most sectors are heavily restricted due to geopolitical tensions. Understanding the current status of US trading with Russia helps businesses stay compliant with international law.

2. How has the Russia-Ukraine war affected US trading with Russia?

ANSWER: The war drastically changed US trading with Russia—sanctions cut off most energy, defense, and tech-related trade. Only a few humanitarian or non-sanctioned items are allowed today.

3. What countries does the US rely on the most for oil imports?

ANSWER: While US oil imports come from various countries, top sources include Canada, Mexico, and Saudi Arabia. Russia was once a key supplier, but imports from Russia have dropped significantly since 2022 due to sanctions.

4. Does the US still import any oil from Russia?

ANSWER: No, as of recent years, US oil imports from Russia have been nearly eliminated due to sanctions and political pressure. The US has shifted toward alternative sources to meet its oil needs.

Conclusion

- What does the U.S. import from Russia? Primarily fertilizers, metals (platinum/palladium), and enriched uranium.

- How much oil is imported? Roughly 30–35% of consumption in 2025—far lower than historically.

- Why still import oil? Refinery configurations and infrastructure constraints.

- The U.S. trading with Russia? Minimal but strategic—imports continue despite geopolitical friction.

- Why does it matter? Economic vulnerability, energy security, and broader geopolitical trade-offs.

In short, 2025 reveals a U.S. asserting independence—but not entirely untethering itself. As you track global trade shifts, remember that even small import lines harbor outsized significance.