In the unpredictable world of cryptocurrency, even a single market signal can spark major moves and in 2025, that signal came from the DTC Indicator. Known for its precision, this tool recently triggered a solid “Buy” signal on Bitcoin. Naturally, this got traders, investors, and crypto watchers buzzing.

So what does this actually mean for the price of Bitcoin today? Is this just another flash in the pan or something worth watching closely?

Let’s break it down from how the signal works to what might come next.

Table of Contents

What is the DTC Indicator?

While the DTC Indicator gained attention for signaling major moves in Bitcoin, it’s far more versatile than just crypto. In fact, it’s a comprehensive trading tool built for all major markets — from equities and forex to commodities and indices.

What makes it powerful is its ability to detect smart money flow, breakout zones, and trend shifts before the crowd reacts. This gives retail traders an edge across:

- Stock market intraday and positional trades

- Futures and options setups

- Swing trading opportunities in forex

- Commodities like gold, silver, and crude oil

Whether you’re trading Nifty, Bank Nifty, Dow Jones, Nasdaq, or even penny stocks the DTC Trading Indicator adapts to every asset class and time frame. Its real strength lies in identifying buy and sell zones early, supported by logic, not lag.

The DTC Indicator (Demand Trend Confirmation) isn’t your typical trading tool. While many rely on basic moving averages or RSI, DTC goes deeper by tracking:

- Volume-weighted trend shifts

- Historical zones where price reacted

- Smart money movements behind the scenes

It’s built for real-world conditions especially in unpredictable markets like crypto and it’s favored by those who want to catch moves early rather than react late.

Why the Buy Signal in 2025 Matters

In early 2025, Bitcoin hovered between $35,000 and $38,000 — a tight range after months of sideways movement. But something changed.

The DTC Indicator lit up with a clear Buy signal based on:

- Heavy on-chain BTC accumulation

- Rising spot trading volume

- Bitcoin outperforming altcoins

These signals weren’t just data points they reflected growing confidence among large investors.

The result? Bitcoin started climbing steadily and crossed $45,000 within weeks.

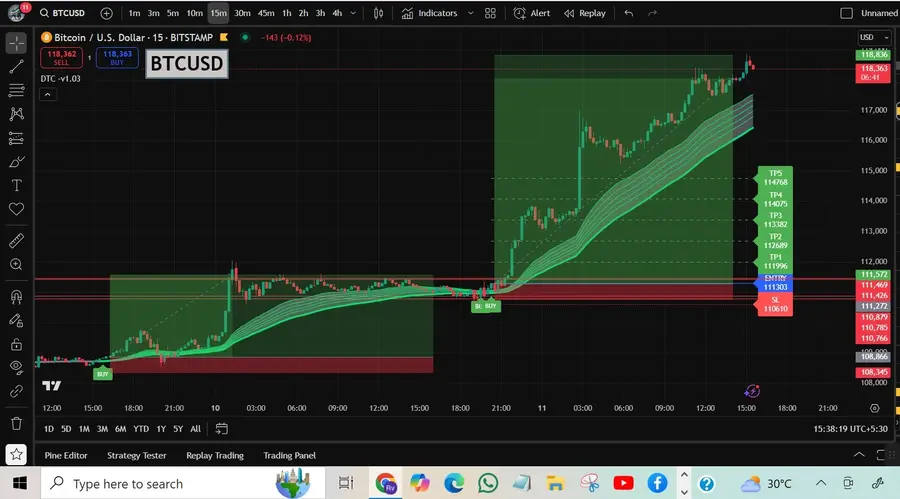

DTC Indicator Setup — What’s Inside?

Here’s a quick breakdown of the key features that make the DTC Trading Indicator a trader favorite.

| Feature | What It Does |

| Entry, Stoploss & Target Levels | Automatically calculates smart trade setups |

| Auto Buy and Sell Alerts | Sends instant alerts when signals are triggered |

| Support & Resistance Levels | Shows key zones to watch for breakouts or reversals |

| Buy and Sell Signals | Highly accurate and easy to interpret |

| ATR Volatility Filter | Helps filter out noise during choppy or fast-moving markets |

| Multi-Timeframe Dashboard | Lets you monitor trends on different timeframes from one chart |

| 85–90% Accuracy, No Repainting | No lag or redraws — just clean, live results |

| Strategy Course Access | Full learning access for beginners and advanced traders |

| Downloadable PDFs | Quick references to understand setups and strategies |

| Works in All Markets | Use it for crypto, stocks, forex, or commodities — one setup fits all |

Why Traders Like It

- Simplifies complex analysis

- Helps avoid emotional trades

- Supports multiple styles: intraday, swing, or positional

Thinking of trying the DTC setup for your own trades? With tools built for fast decisions and clear setups, it might just become your new edge in the market.

How the DTC Setup Helps Traders

The DTC Trading Indicator isn’t just about flashy signals it provides:

- Structure: With defined entry, stoploss, and targets, traders avoid guesswork

- Discipline: It keeps emotional trading in check with alerts and confirmation

- Clarity: Support and resistance levels are mapped in advance for decision confidence

Many traders pair the DTC Trading Indicator with:

- Fibonacci retracement zones

- Trendlines and breakouts

- RSI and MACD for added confluence

This combination results in stronger decision-making and higher confidence in volatile environments like crypto.

BTC Price Movement: What Happened Next?

Following the signal, Bitcoin’s price started gaining momentum crossing $42,000 and then breaking above $45,000.

Key Drivers Behind the Rise:

- Hedge funds and ETFs started increasing crypto exposure

- Mining activity dropped, reducing BTC selling pressure

- Inflation and geopolitical concerns made crypto more attractive

Now, traders are eyeing the $48,000 to $50,000 range as the next big zone.

What Are Traders Saying?

The mood across trading forums and platforms is shifting.

- Whales are moving BTC into cold wallets — a strong sign of confidence

- Institutional traders are relying on DTC signals for structured entries

- Retail interest is returning, though still cautious

Overall sentiment has turned bullish, and this time, the momentum feels more organic.

How Reliable Is the DTC Indicator?

No indicator guarantees profits but historical performance matters.

- Identified the 2020 rally when BTC was at $11K (before hitting $60K)

- Predicted a key drop in 2022 from around $48K

Its success lies in volume-confirmed trends and its ability to filter out fake moves something many basic tools can’t do.

Traders also mention less stress when using DTC, thanks to clear dashboards and consistent signals.

Watching Bitcoin Today? Here’s What to Monitor

If you’re following the Bitcoin price today, watch for:

- Weekly candle closings above $45K (bullish confirmation)

- Balance between spot vs. derivative volumes

- Whale wallet movements and chain inflows

- Stablecoin inflow to exchanges (signals buying pressure)

Pairing this data with the DTC setup can offer sharper clarity in decision-making.

What It Means for the Rest of the Crypto Market

Bitcoin doesn’t move alone when it surges, others usually follow. Here’s what might be next:

- Ethereum looks ready to reclaim $3,000+

- DeFi projects are gaining traction again

- Layer 2 and infrastructure tokens are pulling investor attention

- NFT and GameFi sectors are slowly reviving

Smart Tip:

Avoid jumping in blindly. Use tools like DTC to guide your entries with a plan.

FAQS:

1. Is it safe to buy Bitcoin based on technical indicators like DTC?

ANSWER: While DTC signals can be helpful, it’s best to use them with other tools and market research. No indicator guarantees success always assess risk and invest wisely.

2. Should I buy Bitcoin now that DTC shows a buy signal?

ANSWER: A DTC buy signal can be a strong indicator, but your decision should also depend on personal risk tolerance, investment goals, and other market factors.

3. What is Bitcoin and how does it work?

ANSWER: Bitcoin is a digital currency that works without banks. It uses a technology called blockchain to record transactions securely and publicly.

4. Why is the DTC Indicator giving a strong buy signal for Bitcoin in 2025?

ANSWER: In 2025, the DTC has triggered a strong buy signal due to a breakout above key moving averages, rising volume, and bullish momentum patterns, indicating potential long-term price growth.

5. What could cause the DTC signal to change after this bullish alert?

ANSWER: Factors like sudden market news, regulatory changes, or whale movements can reverse trends quickly, even after a bullish DTC signal. Always monitor updates.

Final Thoughts

The DTC Trading Indicator Buy Signal in 2025 could mark the start of a new bullish phase and unlike hype-driven rallies of the past, this one seems built on solid ground.

If you’re serious about trading or just want smarter signals this might be the tool that levels up your strategy.

Trade with clarity. Trade with confidence. Trade with DTC.